Get A Fix On Tax Savings

In the rush to save tax, have you paused to think whether you are buying all the wrong products? It’s important to look at each of the tax-saving products before committing funds to them. Above all, it’s crucial to link your investments to long-term financial goals. Tax-saving should always

be incidental.

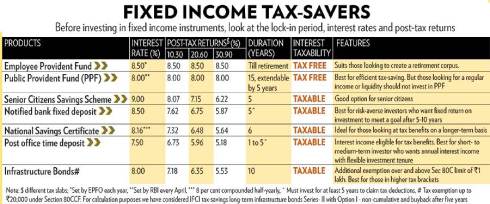

The fixed side. Most tax-saving instruments (see Fixed Income Tax-Savers) provide a fixed regular income. Before investing in such debt products, it’s important to examine their tenure, frequency of interest payments and the taxability of the interest amount. None of the fixed income tax-savers have durations of less than five years. A few of them offer quarterly interest payouts; others only on maturity. Further, most of them are taxable in nature, thus, adding to your tax liability.

What they offer. You may choose to invest the entire limit of Rs 1 lakh under Section 80C of the Income Tax Act in market-linked tax-saving products such as equity-linked saving schemes (ELSS), or growth unit-linked insurance plans (Ulips). However, if you choose debt-based products, let’s see what shape your portfolio should take. Public Provident Fund (PPF) should be a must-have for all, especially those under 50. It’s an ideal instrument to accumulate tax-free corpus over 15 years and is extendable later on. Retirees and senior citizens may consider the Senior Citizens Savings Scheme (SCSS) as it fetches the highest interest among all options. Notified tax-saving bank deposits could be the next pit-stop. Remember, interest from SCSS and bank deposits is taxable.

NSCs are medium-term options, with no regular income during the tenure. Buying them on regular intervals creates a regular flow of income as and when they mature. The infrastructure bonds under Section 80 CCF are useful, especially for those who have exhausted Section 80C limit.

Post-tax return. An eye on the post-tax return is very essential as income from some of the fixed income products is tax-exempted, whereas others are taxable. For instance, both PPF and infrastructure bonds carry the same rate of return, that is 8 per cent and also provide tax exemption while investing. But the earnings from PPF are exempt from tax, while that from bonds are taxable. This ultimately reduces the return from infrastructure bonds. The difference in the net yield from both the products for a person in the low-tax bracket and another in a higher-tax bracket is 0.73 and 2.48 per centage points, respectively.